The United States has developed a reputation as the country with the toughest anti-money laundering regime and the most aggressive policies to combat illicit finance in the world, argues Josh Kirschenbaum, the Senior Fellow for Illicit Finance at the German Marshall Fund’s Alliance for Securing Democracy and a former Treasury Department official:

The United States has developed a reputation as the country with the toughest anti-money laundering regime and the most aggressive policies to combat illicit finance in the world, argues Josh Kirschenbaum, the Senior Fellow for Illicit Finance at the German Marshall Fund’s Alliance for Securing Democracy and a former Treasury Department official:

Large fines against banks act as a deterrent and spur investments in compliance. Strong criminal law enforcement efforts result in investigation and prosecution of money launderers. Americans would need to look back a decade to the exploitation of HSBC’s U.S. and Mexico operations by drug cartels, or even earlier to the infiltration of the Bank of New York by Russian money launderers in the 1990s, to identify a truly massive money laundering scandal. The strict treatment of banks in violation of anti-money laundering policies has established deterrence and keeps everyone invested in a culture of compliance.

But this narrative is incomplete, he writes for The American Interest. If the banks are the well-guarded front door to the U.S. financial system, electronic payments companies, private investment funds, and, to a lesser extent, securities firms are the back door left open—and the opening grows wider as these business models grow in importance. RTWT

The current protests in Russia are partly motivated by the regime’s kleptocratic nature, observers attest.

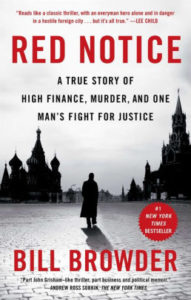

In an interview with Salon in January another outspoken critic of Putin’s corruption, billionaire Bill Browder, author of Red Notice (above), explained that his regime is a kleptocracy.

“I think the best comparable would be Pablo Escobar,” Browder told Salon. “Putin is a criminal. He’s committed enormous financial crimes of unimaginable magnitude over the last 19 years against his own country. Because he’s committed those crimes, and it was just reported today that 1 in 4 Russians don’t even have an indoor toilet, they’re so poor. Those crimes have impoverished the Russian people.”