The financial sectors of the UK and other Western democracies “have helped to facilitate the authoritarianism and systemic corruption that blights Russia,” according to a new analysis from Chatham House, the London-based foreign policy think-tank.

“This challenges the assumption, which guided Western policy for much of the post-Cold War period, that integration with the global economy would drive democratization in Russia by empowering the private sector and enabling it to assert itself in its relations with the authorities there,” analyst Duncan Allan writes in Managed Confrontation UK Policy Towards Russia After the Salisbury Attack:

As one scholar has put it, ‘financial internationalisation evolved hand in hand with growing authoritarianism, an increasing use of repressive methods of control, and reduced liberties for the Russian population’. This is so because asset securitization overseas reduces the incentives for Russia’s elite to push for improved governance at home. Again, the implications for the UK’s much-prized reputation as a champion of democracy, human rights and rule of law are severe.

As one scholar has put it, ‘financial internationalisation evolved hand in hand with growing authoritarianism, an increasing use of repressive methods of control, and reduced liberties for the Russian population’. This is so because asset securitization overseas reduces the incentives for Russia’s elite to push for improved governance at home. Again, the implications for the UK’s much-prized reputation as a champion of democracy, human rights and rule of law are severe.

The report details four cases of how vast amounts of potentially illicit money have entered the UK financial system from Russia:

- The ‘Global Laundromat’: The alleged laundering of over $20 billion from Russia via banks in Eastern Europe and from there to a network of companies – including entities incorporated in the UK.

- ‘Mirror trading’ by Deutsche Bank: Related corporate structures in Moscow and London bought and sold the same quantities of the same stock, worth an estimated $10 billion, via Deutsche Bank’s Russia-based subsidiary.

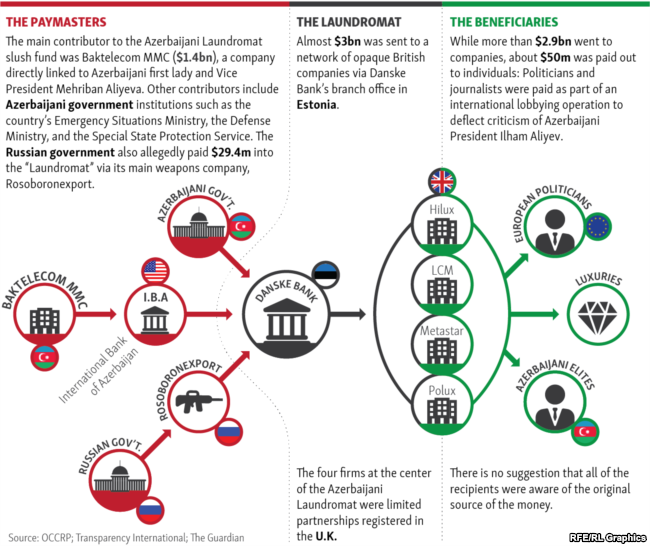

The ‘Azerbaijan Laundromat’ (above): Between 2012 and 2014 four UK-registered companies were part of a network of vehicles that processed an estimated $2.9 billion of suspect finance. Among those involved were senior figures in Azerbaijan’s elite and Russian entities, including Rosoboroneksport, Russia’s state-owned arms-export corporation, which is subject to US sanctions.

The ‘Azerbaijan Laundromat’ (above): Between 2012 and 2014 four UK-registered companies were part of a network of vehicles that processed an estimated $2.9 billion of suspect finance. Among those involved were senior figures in Azerbaijan’s elite and Russian entities, including Rosoboroneksport, Russia’s state-owned arms-export corporation, which is subject to US sanctions.- Property transactions: In written evidence submitted to the House of Commons FAC in April 2018, Transparency International UK stated that UK properties with a combined estimated value of some £4.4 billion had been ‘bought by those representing a high money laundering risk’. Of this total, an estimated £940 million was related to Russian individuals.

Kleptocrats Koncerned

Earlier this year, the British authorities announced the introduction of “Unexplained Wealth Orders,” legislation is designed to check on wealth the source of which owners cannot easily account for, analyst James Rodgers writes for Forbes. It seems to have some rich Russians in London worried. Last weekend, The Financial Times offered the view that Russian oligarchs in London were “starting to look wholly endangered.”

The UK’s lenient approach to the financial shenanigans of Russia’s kleptocrats threatens to undermine democratic institutions, Allan (left) suggests in the Chatham House report:

The UK’s lenient approach to the financial shenanigans of Russia’s kleptocrats threatens to undermine democratic institutions, Allan (left) suggests in the Chatham House report:

Apart from the negative economic effects of exposure to large-scale suspect financial flows from Russia (and elsewhere), for example on the UK’s housing market, the impact on the integrity and the workings of public and private institutions can be substantial. As well as potentially compromising individuals in sensitive positions and causing reputational harm or leaving them vulnerable to pressure, the corruption that goes hand in hand with illicit finance – and the widespread perception of it – can erode public trust in institutions.

“By sowing suspicion, cynicism and alienation, over time it can jeopardize the functioning of democratic and law-based systems,” Allan contends. RTWT